Stall Tactics don't always happen, and they are rare;

but if they do here is some education so you're prepared and not surprised :

Credit bureaus have begun sending these letters in an attempt to intimidate credit repair companies or individuals into dropping their dispute requests. It is crucial as the client of credit repair services to understand we are standing up for your rights under the law. Stall tactics can typically be divided into two groups:

- Suspicious Request: These stall tactics are used when a credit reporting agency deems that the dispute letter sent was a form letter. They stall by rejecting the dispute based on the notion that the request was not sent by the consumer. Language is typically similar to the following: “We have received a suspicious request in the mail regarding your personal credit report and determined that it was not sent by you Suspicious requests are reviewed by security personnel who work regularly with law enforcement officials and regulatory agencies to identify fraudulent and deceptive correspondence purporting to originate from consumers. In an effort to safeguard your personal information from fraud, we will not be initiating any disputes based on the suspicious correspondence.”

- Frivolous Request: These stall tactics are based on section 611 of the Fair Credit Reporting Act (FCRA) which states that “A consumer reporting agency may terminate a reinvestigation of information disputed by a customer if the agency reasonably determines that the dispute by the customer is frivolous or irrelevant, including by reason of a failure by a consumer to provide sufficient information to investigate the disputed information.”

It is important that you not let these types of intimidation techniques bait you into giving up on the process. You do have the rights to contact the Credit Bureaus once receiving these letters in the same manner you you have every right to allow us to dispute items on your credit report, you also have every right to contact the bureaus on your own behalf.

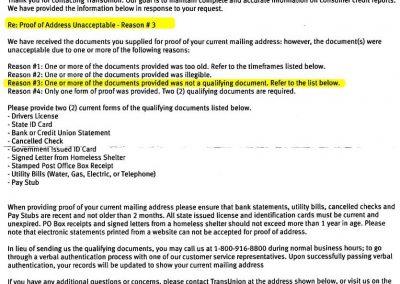

- This is to educate you on what a typical stall response looks like and that they are predictable.

- Below are example and samples of stall responses.

- This is to inform you and to educate you about classic examples and generic stall tactic so there is no surprises.

Remember that federal laws exist to protect yourself as a consumer from being taken advantage of. The more you know about the laws, the more confident and prepared you will be if and when you see these responses.

IF and when we receive these stall tactics we will Maintain a consistent approach by responding to the stall tactics with the following facts:

- Reassert that all customer ID documents were in place in the original dispute request.

- Reiterate the reasons for the dispute and explain that they were clear, conspicuous and obvious in the original request.

- Notify the bureau that any additional stall tactics will be considered a violation of FCRA.

It is important to remember that we are your trusted advisor and, in some cases, your only line of defense from being taken advantage of by credit bureaus. We will stand our ground and educate our clients so that you are prepared when we respond to these stall tactics for the most successful outcome possible.