Mortgage-Ready Credit Results

Fort Worth Credit Repair That Builds Mortgage-Ready Scores Across DFW & Texas

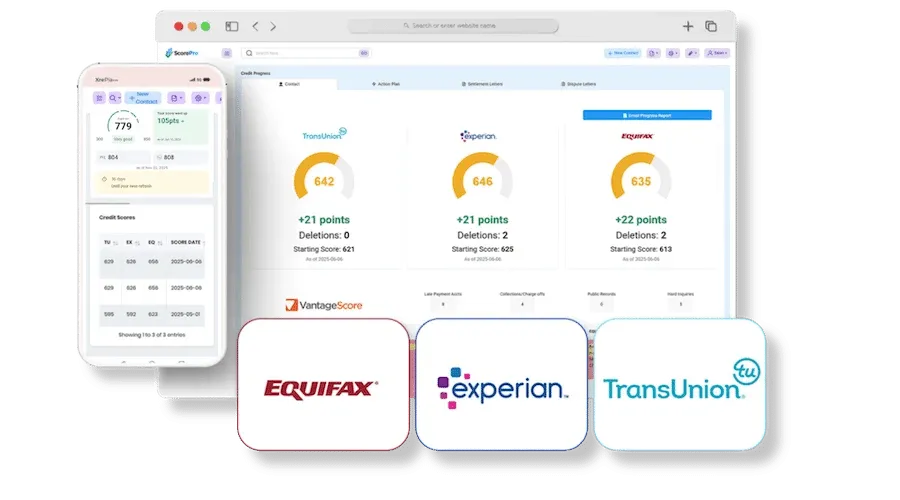

Our proven approach starts with a thorough, three-bureau credit report analysis (Equifax, Experian, and TransUnion) to pinpoint errors such as incorrect late payments, duplicate accounts, accounts that don't belong to you, outdated collections, or items past the statute of

limitations. Once identified, we craft and submit targeted, professional dispute letters directly to the credit bureaus and original creditors on your behalf—following up persistently until each item is properly investigated.

Key benefits our clients experience include:

• Significant FICO score improvements — Many see noticeable gains within the first few months as negative inaccuracies are corrected or removed.

• Higher chances of loan approvals — A stronger credit profile makes it easier to qualify for mortgages, refinances, personal loans, and credit cards with better terms.

• Lower interest rates and fees — Even a 50-100 point increase can save thousands over the life of a home loan or other major financing.

• Reduced stress and clearer path forward — With clear monthly progress tracking, detailed updates, and an easy-to-use client portal, you'll always know exactly what's happening with your credit—no surprises.

We emphasize ethical practices every step of the way: We only challenge items that are inaccurate, unverifiable, or non-compliant with federal and state laws. Our clients benefit from personalized plans, ongoing credit education (so you can maintain and build positive habits

long-term), and dedicated support from a team that truly cares about North Texas families.

Fort Worth Credit Repair • Attorney Backed

Clean Credit. Stronger Financial Opportunities.

Our certified credit specialists review every line of your credit report to identify potential FCRA or FDCPA violations. If creditors or collection agencies violate your rights, our team and partner attorneys can pursue enforcement through disputes, arbitration, or litigation.

We identify FCRA and FDCPA violations and escalate when creditors fail to comply.

We analyze reporting format errors that frequently trigger deletions or corrections.

We challenge inaccurate, incomplete, or unverifiable information legally and ethically.

Helping Fort Worth and Dallas Residents Improve Their Credit Scores

Best Texas Credit Pros provides professional credit repair services in Fort Worth and throughout the Dallas–Fort Worth area. We help individuals and families remove inaccurate negative items from their credit reports, improve credit scores, and qualify for better financial opportunities through ethical, compliant credit repair.

Genuine local support. Authentic outcomes. Choose a credit repair company Texas families trust. Our Fort Worth credit repair team reviews all three major bureaus (TransUnion, Equifax, Experian), identifies what’s inaccurate, outdated, or unverifiable, and builds a personalized action plan designed to deliver measurable results—without shortcuts.

As a trusted credit repair company in Fort Worth, Best Texas Credit Pros serves North Texas with transparent, results-focused service. We help address common credit reporting issues like late payments, collections, charge-offs, repossessions, and other reporting errors—while staying aligned with federal credit regulations.

How Our Fort Worth Credit Repair Process Works

- Free credit evaluation to identify inaccurate, outdated, or unverifiable negative items

- Targeted disputes sent to bureaus and creditors using a proven credit repair process

- Ongoing monitoring and updates so you always know what changed and what’s next

- Credit education and guidance to protect gains and improve long-term stability

We proudly serve clients in Fort Worth, Dallas, Arlington, and across DFW. Whether you’re preparing for a mortgage approval, rebuilding after financial hardship, or looking to understand credit repair costs in Texas, our team manages the process end-to-end so you can focus on your goals with confidence.

If you're looking for trustworthy credit repair services in Texas, you've likely encountered many companies making grand promises. At Best Texas Credit Pros, what sets us apart is our commitment to providing genuine, lasting results for families in Texas—no exaggerated claims, just dedicated service.

Whether you seek the top credit repair company in the DFW area, reputable credit repair services you can rely on, or professional assistance from a legitimate provider, our Fort Worth-based team excels in expert credit repair that addresses inaccuracies and supports you in achieving the credit scores you deserve. Many clients discover us while researching leading credit repair firms, looking for the best services, or simply wondering, "Which credit repair company is the best?"—and they choose us for our transparent approach and proven success throughout Dallas, Fort Worth, Arlington, Houston, and beyond.

We're proud to be a genuine local choice for those searching for a credit repair company nearby, including credit repair in Dallas, Houston, or Fort Worth. With disputes backed by attorneys, customized credit repair letters, and comprehensive client education that extends beyond basic knowledge, we consistently receive excellent reviews as the best credit repair company recommended by Texas residents. If you're ready for assistance from true credit repair professionals, we're here to support you every step of the way.

This is Your Life, Family, and Future

Best Texas Credit Pros

FAQ Credit

for Fort Worth & Dallas

-

Credit repair in Texas begins with reviewing your credit reports for inaccurate, outdated, non-compliant, or unverifiable items. Disputes are then sent to the credit bureaus and, when necessary, creditors, while progress is tracked over time. Multiple waves of disputes may be used based on responses for stronger results. Learn more about our credit repair process.

-

Yes. Credit repair is legal in Texas when performed in compliance with state and federal law. Avoid any company that guarantees results or promotes dishonest tactics. Legitimate work challenges reporting through compliance and factual dispute methodology to hold bureaus accountable. See our Texas credit repair laws guide.

-

Many clients see changes within 30–90 days, but timelines vary depending on your credit file and bureau response times. Older items may resolve faster; typical clients see around 4–6 months for meaningful improvements. Not everything comes off—some items may be verified and compliant—so strategy matters. Learn more about Fort Worth credit repair.

-

Improving your credit profile can help you qualify for better loan terms, especially when errors and inaccuracies are removed. Reducing derogatory accounts and maximizing the major score categories can help you reach lender approval ranges. Some programs start around 580, while others may require closer to 640+ depending on the lender and file. See credit score needed for a mortgage in Texas.

-

Pricing varies by the firm. A legitimate company clearly explains monthly fees, what’s included, and cancellation rights before work begins. Some companies charge a large upfront fee; others spread costs over months so you can track value against results. See average credit repair cost in Texas.

“Decide to take control of your financial future and stop allowing bad credit to hold you back. At Best Texas Credit Pros, we’ve successfully eliminated tens of thousands of negative items for families across Texas, just like yours. With no upfront fees, impressive results, and a commitment to helping many reach their goals, we make credit repair straightforward, transparent, and effective. Sign up today or request your free consultation—because every Texan deserves a new beginning financially.”

Thank You!

Your Consultation Request has been successfully submitted.

We will contact you soon!

A credit expert from Best Texas Credit Pros will reach out within 24 hours (unless weekend) to discuss your situation and next steps.

To make the process ULTRA SMOOTH,

grab your 3-bureau credit report here:

Quick Facts About Credit Report Errors

- • Federal Trade Commission (FTC): Found one in five Americans (about 20%) had errors, with 5% facing higher costs due to these mistakes.

- • PIRG (Public Interest Research Group): An older study found 79% of reports had errors, with 25% having serious issues like false delinquencies.

- • Consumer Reports (2021 & 2024): Found 34% to 44% of participants discovered errors, including unrecognized accounts (27% in 2024) and personal info mistakes (34% in 2024).

Do spouses get a discount?

Yup! we give 1/2 off discount to your better half

Best Texas Credit Pros

You deserve a credit repair company that is just as dedicated to your success as you are. Best Texas Credit Pros has assisted thousands of families across Texas in removing negative items from their credit reports and improving their scores—averaging an increase of 87 points with a success rate of 73%. Located in Fort Worth, Dallas, and Arlington, we employ attorney-driven disputes and ensure full compliance with the FCRA and FDCPA to deliver the results you need for a home, a car, or simply peace of mind. There are no upfront fees; you only pay once you see deletions on your report.

Copyright © 2026Best Texas Credit Pros, LLC – All Rights Reserved | Fin. Code § 393.002.