Key IRS Rules for 1099-C Issuance

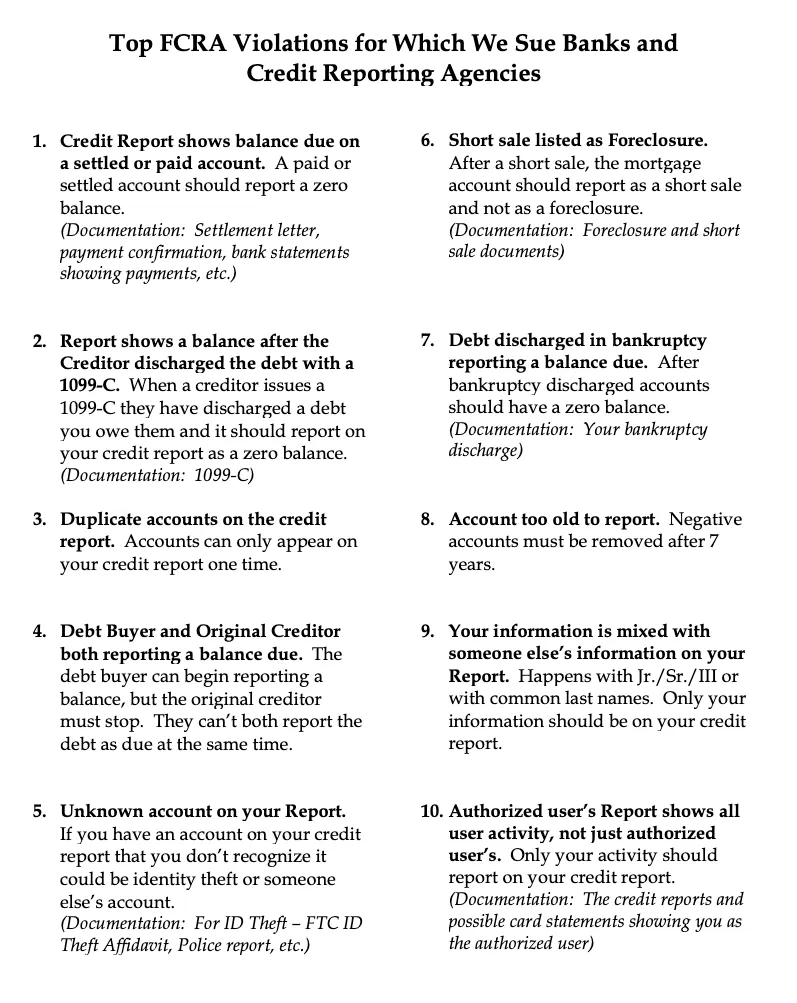

The IRS requires creditors to file Form 1099-C (Cancellation of Debt) only when:

- The canceled/forgiven debt is $600 or more (principal amount).

- An “identifiable event” occurs that signals the debt is officially canceled (not just charged off).

- The creditor is an “applicable entity” (banks, credit card companies, etc.).

A charge-off itself is not an identifiable event — it’s an accounting write-off where the creditor stops expecting full payment but may still pursue collection (sell to debt buyers, etc.). So many charge-offs never trigger a 1099-C.

Common “identifiable events” that do trigger a 1099-C include:

- Creditor’s internal policy to stop collection and discharge the debt (most common for credit cards).

- Expiration of statute of limitations for collection.

- Settlement for less than full amount (e.g., you negotiate payoff for 30–50%).

- Bankruptcy discharge.

- Creditor decides debt is uncollectible (sometimes after years of no payments).

How Often / Likelihood After Charge-Off

- Not very often immediately — Charge-offs happen ~180 days after last payment, but creditors often wait 1–3+ years (or never) to officially cancel and issue 1099-C.

- Likelihood: Roughly 30–60% of large credit card charge-offs eventually get a 1099-C (based on tax professional forums, debt relief reports, and IRS data trends). Many debts are sold to collectors instead of canceled outright.

- Timeline if they do issue one:

- Creditor must send by January 31 of the year following the cancellation year.

- Example: Debt canceled in 2025 → 1099-C by Jan 31, 2026.

- Some wait 1–4 years after charge-off (e.g., after selling debt or statute expires).

- Never issued: If debt is sold/transferred, collector may continue collection without canceling, so no 1099-C.

Bottom Line

- A charge-off alone does not mean you’ll get a 1099-C or owe taxes on it.

- You only report canceled debt as income if you receive a 1099-C (or know debt was forgiven >$600).

- If you get one years later → it’s still valid (creditor can issue anytime they cancel).

- If no 1099-C → no tax reporting needed (even if charged off).