Best Credit Repair Company Guide

~credit repair classes~

Texas Credit Repair – How It Works

Join host @BestTexasCredit as we reveal the exact 3-step system that’s helped thousands of Texans remove negatives and raise scores fast

From Dallas to Fort Worth, Houston to Austin — here’s exactly how real credit repair works in Texas (no fluff, no secrets)

In This Episode You’ll Discover:

- How to get your FREE consultation + full 3-bureau credit analysis in minutes

- Why custom dispute letters + your own cloud login portal = results every 35–45 days

- The FCRA laws that force bureaus to delete inaccurate, unverifiable, or incomplete items

- How we build positive credit while removing negatives — no DIY mistakes!

- Real client story: “From 520 to 712 in just 8 months!”

- Aggressive yet 100% legal strategies from our FICO-certified, attorney-backed team (23+ years)

Key Takeaway: Your goals are our purpose. We don’t just send disputes — we coach you, track progress, and deliver transparent results.

Fast Results: Most clients see removals in 30–45 days. Zero hidden fees. No high-pressure sales.

Serving all of Texas • Fully insured • CSO Licensed • Bonded

Ready for Your Own Credit Success Story?

Average client gains 112+ points with our Texas Credit Fix Guarantee + exclusive Spouse 50% Off

Get Your Free Consultation NowFactual Verification Under FCRA

The Legal Process That Forces Deletions

Attorney-drafted disputes • 30-day investigations • FTC/CFPB complaints • How we remove negatives the right way

What is the Fair Credit Reporting Act (FCRA) in Simple Terms?

The FCRA is your constitutional right: Every item on your credit report must be 100% accurate, complete, and verifiable — or it gets deleted.

The Exact 4-Step Factual Verification Process We Use

Attorney-Drafted Disputes Filed

Perfect FCRA language to bureaus + direct to creditors

30-Day Investigation Forced

Can’t prove it? Must delete it.

FTC & CFPB Complaints Filed

One per bureau + one per creditor (up to 13+)

15 Days to Fix or Delete

Or face massive fines for non-compliance

Watch the Full Video Breakdown

This is how we legally remove bankruptcies, collections, charge-offs, late payments, repossessions, and judgments for Texas families every month.

Ready to Start Your Own FCRA-Powered Credit Fix?

Average client gains 112+ points • Texas Credit Fix Guarantee • Spouse 50% Off

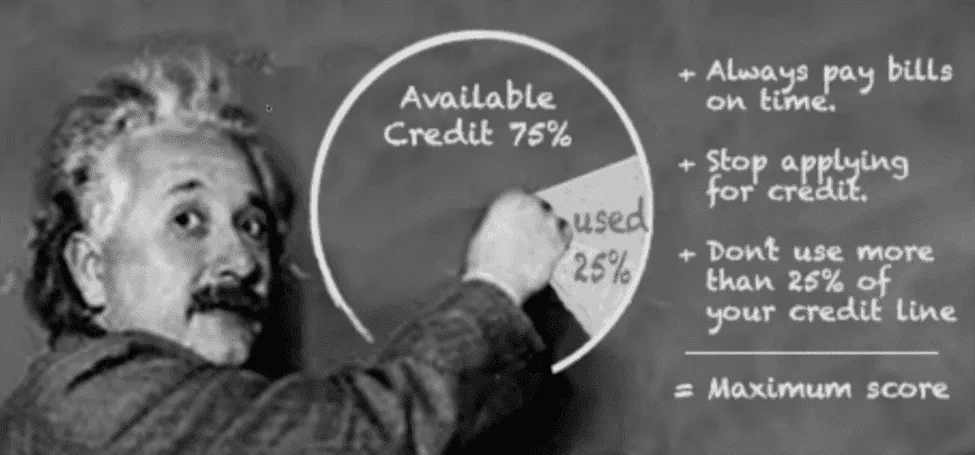

Get Your Free Consultation NowCredit Utilization 2025

Why Pros Keep It Under 10% (Not Just 30%)

30% of your score • Exact point drops at every level • Fastest ways to get under 10%

Utilization is the #1 factor you control 100%. Drop from 70% → under 10% and many Texas clients gain 150–250 points in a single month.

| Utilization | Impact | FICO Drop | VantageScore Drop | Pro Verdict |

|---|---|---|---|---|

| 0–9% | Max points | +0 | +0 | 800+ club territory |

| 10–29% | Still excellent | -5 to -20 | -10 to -30 | Great for most people |

| 30–49% | Damage begins | -30 to -80 | -40 to -100 | “30% is fine” = myth |

| 50–69% | Serious hit | -80 to -150 | -100 to -180 | Lenders hate this |

| 70–99% | Major damage | -150 to -250 | -180 to -300 | Worse than a late payment |

| 100%+ | Disaster | -200+ | -250+ | Instant 200–300 point drop |

Fastest Ways to Get Under 10%:

- • Pay balances multiple times per month (before statement closes)

- • Request credit limit increases (many issuers give 50–100% with soft pull)

- • Add high-limit cards (Chase Sapphire, Amex Gold, Capital One Venture X often start $15k+)

- • Become an authorized user on a family member’s high-limit, low-util card

- • Use 0% balance transfers → old cards report $0

- • Never close old cards — reduces total available credit

Real talk: People with 800+ scores average 4–7% utilization. Drop from 70% → under 10% = easily 150–250 points in one month.

3-Bureau Credit Monitoring That Actually Protects You

Easily Detect Errors

An error on your credit report could cost you hundreds of points and thousands in higher interest.

With Best Texas Credit Pros’ 3-bureau monitoring, you’ll spot mistakes the second they appear — so we can remove them fast.

![]()

Receive Real-Time Alerts

Get instant notifications the moment anything changes on your Equifax, Experian, or TransUnion reports — new inquiries, accounts, address changes, you name it.

![]()

Protect Your Identity 24/7

Identity theft can destroy your score overnight. Our monitoring catches fraud early — before it turns into collections, charge-offs, or denied mortgages.

Don’t have 3-bureau monitoring yet?

Best Credit Cards by Credit Score 2025

From no credit to 800+ FICO — the top secured, fair-credit, good-credit, and ultra-premium cards (updated December 11, 2025)

No matter where your score is today, there’s a perfect card waiting — with current welcome bonuses worth hundreds (or thousands) in value.

| Card | Score Needed | Welcome Bonus | Annual Fee | APR | Why It’s Best |

|---|---|---|---|---|---|

| OpenSky® Secured Visa® | No credit check | — | $35 | 25.64% | No-check secured card, reports to all 3 |

| Discover it® Secured | No minimum | Cashback Match (1st year) | $0 | 28.24% | Rewards + free FICO + auto-upgrade path |

| Capital One Platinum Secured | Fair (580+) | — | $0 | 29.74% | Quick increases, possible $0 deposit |

| Capital One QuicksilverOne | Fair (630+) | — | $39 | 29.99% | Flat-rate cash back for fair credit |

| Chase Freedom Unlimited® | Good (670+) | Up to $300 | $0 | 19.99–28.49% | Versatile 5/3/1.5% cash back |

| Chase Sapphire Preferred® | Good (700+) | 60,000–75,000 points | $95 | 20.99–27.99% | Best mid-tier travel rewards |

| Capital One Venture X | Excellent (740+) | 100,000 miles | $395 | 19.99–28.99% | $300 credit + 10k anniversary miles + lounges |

| Chase Sapphire Reserve® | Excellent (740+) | 60,000 points | $550 | 21.99–28.99% | Top-tier travel perks + 50% redemption boost |

| The Platinum Card® from American Express | Excellent (740+) | Up to 175,000 points | $695 | 21.24–29.24% | Lounge access + $2,000+ in annual credits |

| American Express® Gold Card | Excellent (720+) | 60,000–90,000 points | $325 | 20.24–28.24% | 4x dining/groceries + credits |

Poor / No Credit

(Below 580)

Focus on building history fast with secured cards.

→ OpenSky or Discover it Secured

Fair Credit

(580–669)

Graduate to unsecured rewards.

→ Capital One Platinum → QuicksilverOne

Good Credit

(670–739)

Strong no-fee or low-fee rewards.

→ Chase Freedom Unlimited & Sapphire Preferred

Excellent Credit

(740+)

Premium travel & ultra-luxury perks.

→ Venture X, Sapphire Reserve, Amex Platinum

Need Help Raising Your Score to Qualify for These Cards?

Our Texas clients average 112+ point gains with the Texas Credit Fix Guarantee + Spouse 50% Off discount

What Mortgage Lenders & Underwriters

Actually Look For in 2025

The exact checklist Texas home buyers need for fast pre-approval & final approval (updated December 11, 2025)

Loan officers decide if you get pre-approved. Underwriters decide if you actually close. Here’s exactly what both are checking — and how to make sure you pass with flying colors.

| Requirement | Loan Officer Focus | Underwriter Scrutiny | Strong / Ideal | Minimum (2025) |

|---|---|---|---|---|

| Credit Score | Quick pull for rate & program | Tri-merge + recent inquiries | 740+ | 620 conv / 580 FHA / 500 non-QM |

| Debt-to-Income (DTI) | Front <28%, Back <43% | AUS + manual debt verification | ≤36% | ≤50% conv, ≤57% FHA/VA |

| Employment & Income | 2 yrs stable + verbal VOE | W-2s, tax returns, pay stubs, written VOE | Salaried + 2-yr bonus avg | 30 days stubs + 2 yrs W-2s |

| Down Payment & Reserves | Source summary | 2–6 mo statements + gift letters | 20% + 12 mo reserves | 3% conv / 3.5% FHA / 0% VA |

| Assets & Cash to Close | Enough for closing | All large deposits sourced | Fully documented gifts | Seasoned funds (60+ days) |

| Appraisal | Value estimate | Full appraisal ≥ contract | Above contract | Meets contract + repairs done |

| Recent Inquiries | Ask about new apps | LOX for last 90–120 days | None in 6 mo | Explained, no new debt |

| Bankruptcy / Foreclosure | Waiting periods | Exact discharge date | 7+ yrs seasoned | 2–4 yrs FHA/VA, 7 yrs conv |

Fast-Approval Tips Texas Buyers Swear By

- Never open new credit during the process

- Lower revolving balances (utilization <10% is gold)

- Have 3–12 months reserves ready & documented

- Get pre-approved BEFORE house hunting

- Work with a local Texas lender who knows the overlays

Freeze Your Credit at ALL Bureaus in 2025

Big 3 + 12 specialty bureaus • 100% free • Instant protection (updated November 21, 2025)

A credit freeze is the single best free way to stop identity theft and fraudulent accounts. Takes 10–20 minutes total and lasts forever (until you lift it).

| Bureau | What They Report | Freeze Method |

|---|---|---|

| Innovis | Alternative credit data | Freeze Online |

| ChexSystems | Banking history | Online / 800-887-7654 |

| LexisNexis | Background / insurance | Phone 1-800-456-1244 or mail |

| Clarity Services | Subprime / payday loans | Mail only |

| SageStream | Subprime data | Online / 888-395-0277 |

| CoreLogic / SafeRent | Rental history | Phone 1-877-532-8778 |

| NCTUE | Phone & utilities | Phone 1-888-567-8688 |

Already Frozen Everything? Now Let’s Raise Your Score!

Average Texas client gains 112+ points with our Texas Credit Fix Guarantee + Spouse 50% Off discount

© 2025 Best Texas Credit Pros LLC. All Content. All Rights Reserved.

Professional, Customized Credit Repair Solution.

Fully licensed and bonded participant in the Credit Services Organization Tex. Fin. Code § 393.002.

FICO vs VantageScore 3.0

The Real Differences in 2025

Free Texas credit guide — updated November 21, 2025

If you’re checking your credit score, you’ve probably seen two different numbers.

One is your FICO score, the other is your VantageScore 3.0. Here’s exactly how they differ — and why it matters for Texas home buyers, car loans, and mortgages.

| Factor | FICO Weight | VantageScore 3.0 Weight | VantageScore Influence |

|---|---|---|---|

| Payment History | 35% | ~40% | Extremely Influential |

| Credit Utilization / Balances | 30% | ~34% combined | Highly Influential |

| Length of Credit History | 15% | ~21% | Highly Influential |

| New Credit / Inquiries | 10% | ~5% | Less Influential |

| Credit Mix | 10% | Folded into history | Less Influential |

Best Credit Builder Tools 2025

Secured cards • Credit builder loans • Experian Boost • Rent reporting • Authorized user — full comparison (updated November 21, 2025)

From no credit to 700+ in months — here are the fastest, cheapest, and most effective credit-building options available right now in Texas and nationwide.

| Credit Builder | Best For | Cost / Deposit | Reports to All 3? | Our 2025 Rating |

|---|---|---|---|---|

| Secured Credit Cards (Discover it, OpenSky, Capital One) |

Real card habits + rewards | $200–$3,000 deposit | Yes | ★★★★★ |

| Credit Builder Loans (Credit Strong, Self) |

Installment history + savings | $25–$150/mo | Yes | ★★★★★ |

| Chime Credit Builder | No credit check + daily spending | $0 deposit | Yes | ★★★★★ |

| Kikoff | Cheapest possible | $5/mo | Equifax + TU (sometimes Experian) | ★★★★☆ |

| Experian Boost | Free utility/phone/streaming | FREE | Experian only | ★★★★☆ |

| Rent & Utility Reporting (IdentityIQ, Boom, Rock the Score) |

Renters paying on time | $25–$95 one-time | Usually all 3 | ★★★★★ |

| Authorized User | Piggyback family member’s good credit | FREE | Yes (if issuer reports AUs) | ★★★★★ |

Secured Credit Cards

Gold standard. Deposit = credit limit. Many graduate to unsecured cards fast.

- Discover it Secured → 2% cash back + free FICO

- OpenSky → No credit check

- Capital One → Possible upgrade in 6 months

Credit Strong / Self

True installment loans that build payment history + savings. Money returned at end (minus small fee).

Chime Credit Builder Visa

No credit check, no interest. Move money → spend → auto-paid. Reports like a regular card.

Kikoff

$5/month for a $750 revolving line. Instant approval, no deposit, no hard pull.

Experian Boost

Free. Adds Netflix, phone, utilities to your Experian file. Average +13–27 points instantly.

Rent & Utility Reporting

Report up to 24 months of past rent. Huge boost for renters who’ve never had it counted.

Authorized User

Get added to a family member’s perfect card — their good history shows on your report overnight.